Additional Customer Due Diligence and How to Upgrade Your Daily Limit (KYC Upgrade)

Why is additional customer due diligence and daily transaction limit setting required?

To prevent the misuse of digital asset business services for activities related to technology-based crime, the Securities and Exchange Commission (SEC) requires all digital asset service providers to conduct additional customer due diligence before approving transaction limits, in accordance with the Digital Asset Business Association of Thailand's guideline on Measures for Managing "Mule Accounts" in the Digital Asset Industry.

The company must categorize customers and set conditions for digital asset withdrawal transactions in accordance with the notifications and guidelines set by the Securities and Exchange Commission, with the following details:

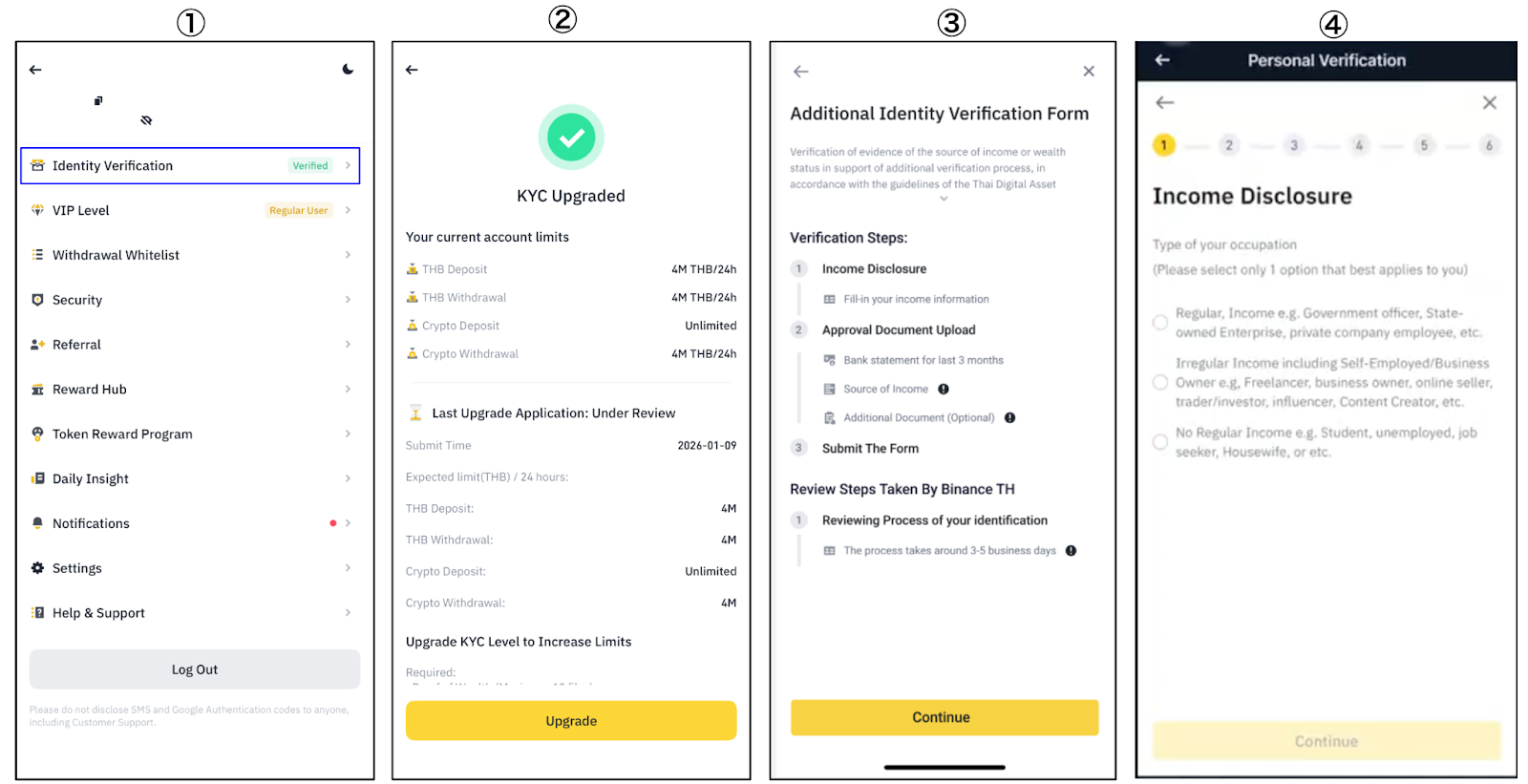

To request an upgrade in the daily withdrawal limit, users must submit the required documents here, or via the Binance TH application or website, by following these steps:

Go to Profile and select “Identity Verification”.

The screen will show the current withdrawal limit. To request an upgrade, click “Upgrade”.

You must submit documents in the personal information verification step by clicking the “Continue” button.

Select the type of your occupation.

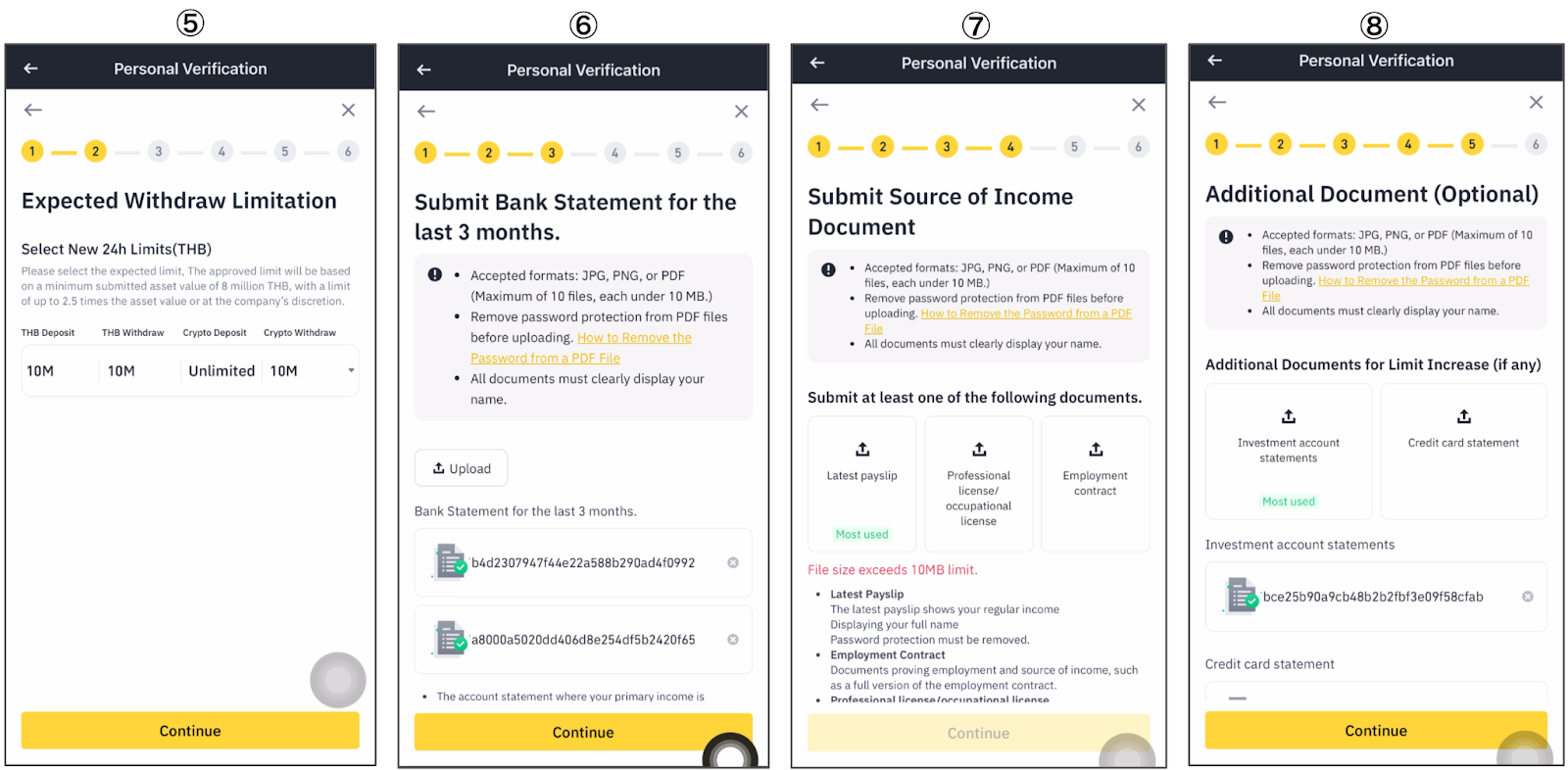

Select your desired withdrawal limit; however, the approved limit will be determined based on all documents you submit.

Submit the latest 3-month bank statement (Required)

Submit document showing the source of income (Required)

Submit additional supporting documents, such as an investment portfolio or credit card statement (Optional)

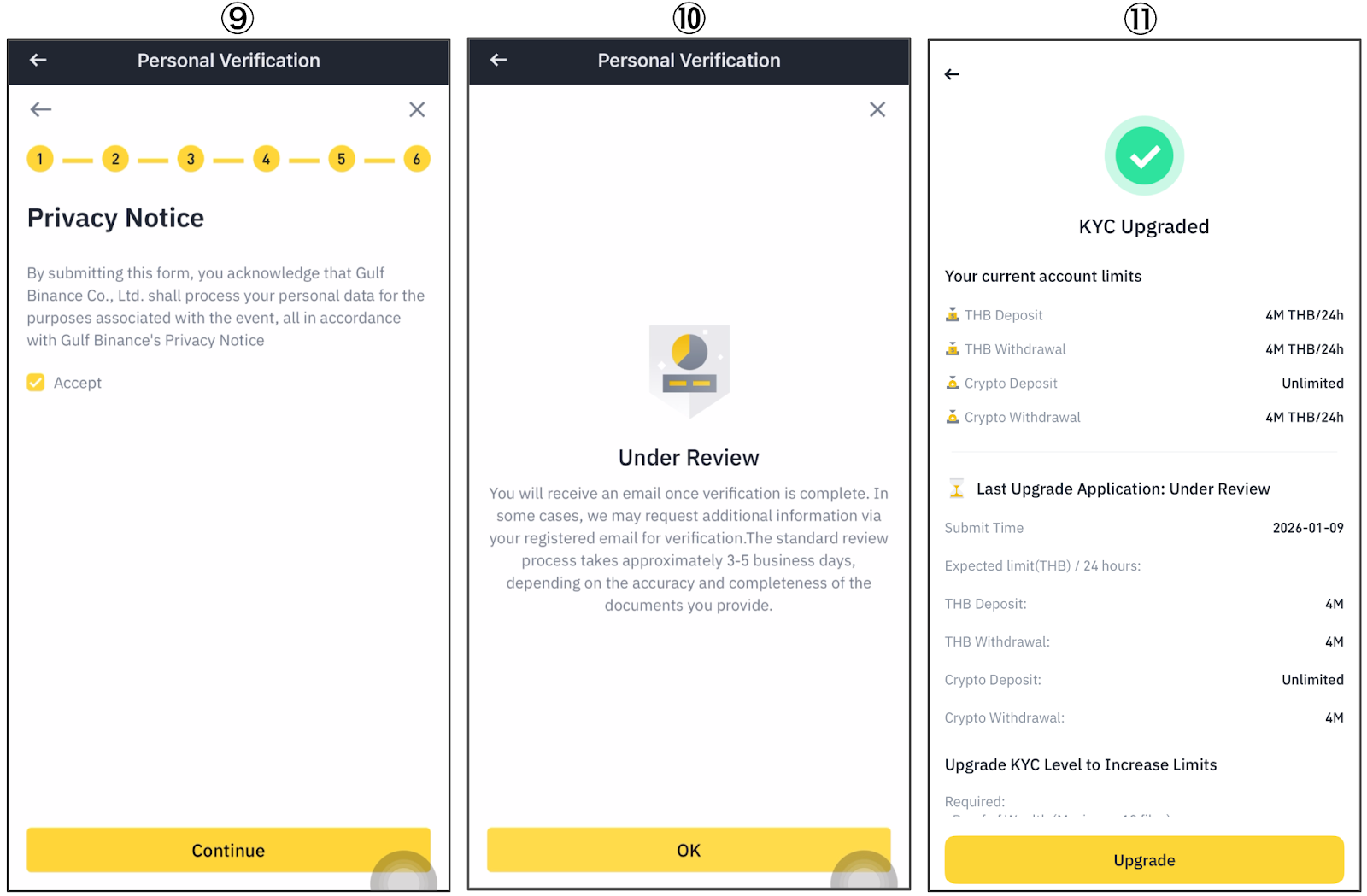

Review and accept the Privacy Policy

The system will notify you on the "Under Review" page. Click Confirm.

Additional Customer Due Diligence documents

The list of documents you must submit consists of 2 parts:

Documents showing your financial status, such as the latest 3 months of bank statements for the account that receives income from your occupation.

Documents of income sources, such as pay slips or employment certificates from employers, etc.

List of documents you may consider submitting

Statement of Assets Held with Other Financial Institutions: This includes documentation of your digital assets, stocks, savings certificates, or investment holdings that clearly show your name as the account holder.

Credit card statement (document issue date must not exceed 3 months)

If you wish to increase your daily transaction limit beyond 4 million THB, you must proceed according to your current KYC level (as shown in the table below) by submitting additional Proof of Wealth documents. The company will assess your transaction limit based on the total value of assets submitted, calculated at 2.5 times of such value, or in accordance with the company’s established criteria. Please note that the name stated on the submitted documents must match the name used for your account registration.

Table showing KYC levels

Note: The request to increase the limit for customers who have completed KYB identity verification will start at Level 3.

You can view the details of each document as follows:

The list of documents you must submit.

Documents showing your financial status:

Documents required are: Bank statement for the latest 3 months from the account where you receive income from your occupation.Documents showing the source of income.

Documents required for submission. You can choose to submit based on your occupation type as follows:Group 1: Salaried Employee Government officer, State-owned Enterprise, private company employee (you can choose to submit one of the following according to the example)

Latest payslip

Other documents verifying your income source (e.g., full employment contract, work agreement)

If you are engaged in a licensed profession, you may submit a copy of your professional license in lieu of an employment contract or a certificate of employment.

Group 2: Self-Employed / Business Owner

Freelance work, such as Freelancer, Influencer Creator, or general employment, etc.

Images from the Application/platform where you accept work or

Images while working, such as images of attending events, images promoting products through online platforms, images while working as general employment, or

Conversations showing employment that show your picture or name

Business owner or online seller

Commercial registration certificate and picture of your business

Bor Chor 5 that shows your name

Evidence of online store ownership, such as images showing sales from the Application where you sell or customer order history from the Application where you sell online, etc., showing your name or email as the owner of the said store account

Trader/ Investor

Investment/Trading portfolio that shows your name as the owner and the all value of the assets you trade.

Group 3: No Regular Income, such as Student, unemployed, job seeker, Housewife, or etc.

Students

Student ID card, certificate of student status, or academic transcript and

Specify the deposit amount and the date the funds were received in the Bank Statement you submit (If the last name does not match, please also submit additional proof of guardianship)

Unemployed/ Job seeker

Explain the source of the investment and

submit supporting evidence.

Housewives/husbands taking care of the family

Documents showing your relationship with your spouse and

Specify the deposit amount and the date the money was received in the Bank Statement you submitted.

If you are not legally married, please explain the relationship and attach supporting evidence.

List of documents you may consider submitting

List of documents in this group, you may consider submitting additional documents for consideration, so that the company can use such documents to consider your service limit, which will be considered based on the information and/or documents you provide.

Statement of Assets Held with Other Financial Institutions: This includes documentation of your digital assets, stocks, savings certificates, or investment holdings that bear your name as the account holder. (if any)

Credit card statement (the document issue date must not be more than 3 months) (if any).

Remark:

The document must clearly show your name and have complete details as shown in the document example

File format: JPEG, PNG, or PDF (no more than 10 files, Maximum size 10 MB per file)

For PDF files: You must unlock the password before submitting. Here is How to Remove the Password from a PDF File

Examples of occupations and documents to be submitted

From the above example, you need to submit documents proving your economic status and documents proving your source of income. You may also consider submitting additional documents such as statements of your assets with other financial institutions or credit card statements.

Document review period and notification of results

The team will expedite the review of the information as soon as possible. The normal review process takes approximately 5 business days, depending on the completeness and accuracy of the documents you submit.

If necessary, in some cases, we may need to request additional documents. The request will be sent to the email address you registered.

Once the verification process is complete, you will receive notifications via email and within the application.

Document Review Criteria

The company reviews documents based on the completeness and accuracy of the documents you submit.

The Company will assess your withdrawal limit based on the information and/or documents you provide.

During the review, what transactions can be made?

You can still deposit baht and digital assets and trade as usual.

If you encounter a problem, where can I contact Binance TH customer support?

If you have any questions, you can ask for more information at Chat Support 24 hours a day via the Binance TH application or via the website at https://www.binance.th/th/chat.